Strength Starts with a Strategy

Meet Your Financial Coach

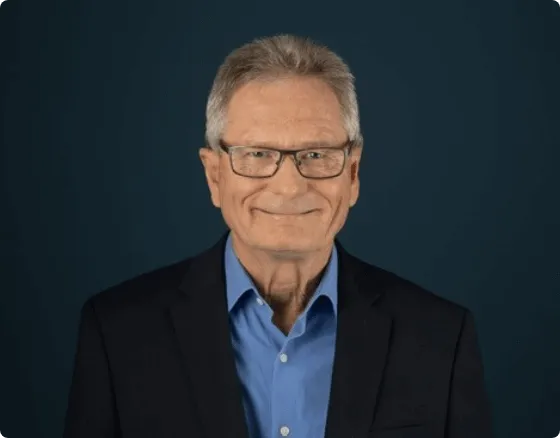

Geoffrey Wight

PRESIDENT & FINANCIAL ADVISOR

“Let’s start with a good defensive position and take it from there.”

At Assets Risk Management, President and Founder Geoffrey Wight’s unwavering commitment is to understand you and your unique lifestyle. He then relentlessly works to help you achieve your financial and retirement goals, providing exceptional client service and fostering profound, lasting professional relationships that stand the test of time.

As a professional, Geoff draws from his experience in managing and promoting high-profile sports and entertainment stars during his tenure at IMG to craft robust financial game plans and strong defenses for his clients. Whether they are educators, equestrians, corporate executives or career athletes, Geoff and his team are dedicated to collaboratively construct personalized financial strategies that support and guide clients on their financial journey through life and into retirement. Leveraging his knowledge in risk management, asset preservation, and growth, Geoff prioritizes understanding his clients’ individual needs and aspirations to help ensure they can live life to the fullest while securing a stable financial future.

Instant Download

Wondering How to Create Income in Retirement?

- What you need to know to understand annuities

- Why savings alone may not be enough for your retirement

- How annuity withdrawal options work

Empowering Your Present, Envisioning Your Tomorrows

A.R.M. Your Future

Retirement Income Strategies

Wealth Management

Asset Protection Strategies

Investments

IRA/401(k) Rollovers

Annuities

Life Insurance

Tax-Efficient Strategies

IRA Legacy Planning

A.R.M. Your Future is our process name. It does not promise or guarantee investments results or preservation of principal.

All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Any statements referring to growing your income are not a guarantee or prediction of future performance. Any references to protection benefits, guarantees or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company.

Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Ready to Visit?

The time is NOW.

Contact us today to start strategizing for your future!